|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

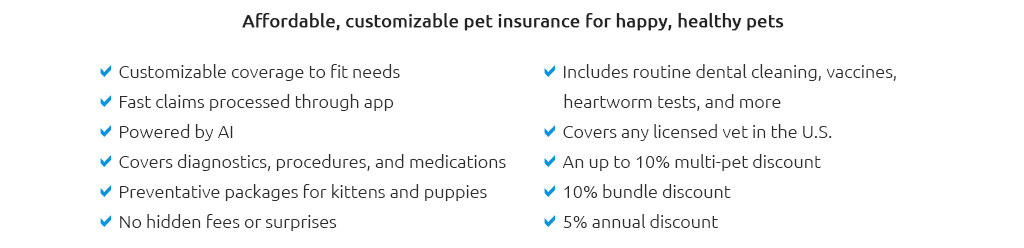

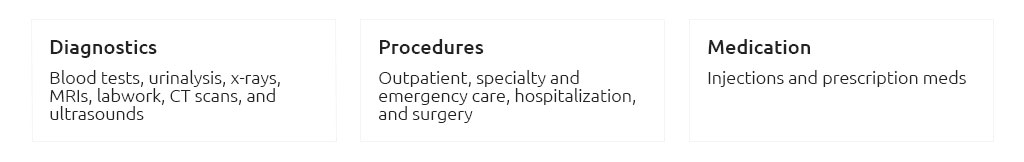

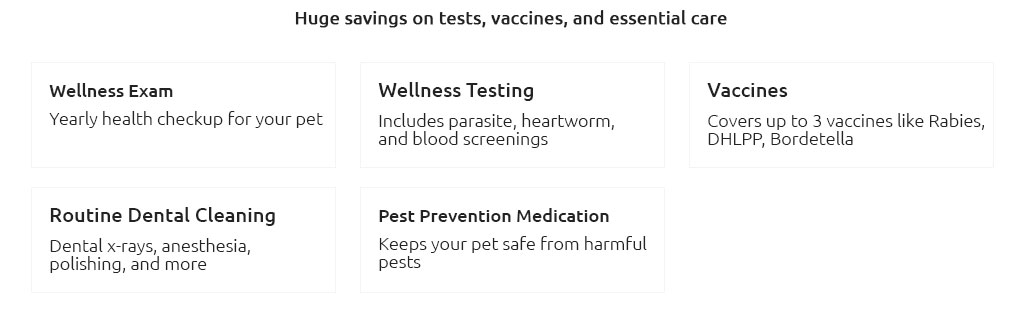

Is There Health Insurance for Dogs?The concept of health insurance is well-ingrained in the human experience, providing peace of mind and financial security amidst life’s uncertainties. But what about our furry friends? Yes, health insurance for dogs is indeed a growing trend, offering pet owners a safety net against unexpected veterinary costs. Much like human insurance, dog health insurance policies vary widely, offering different levels of coverage, premiums, and deductibles. But why consider it, and what should a responsible pet owner know? First and foremost, it’s crucial to understand why pet insurance might be beneficial. The cost of veterinary care can be surprisingly high, especially in cases of emergencies or chronic conditions. Treatments such as surgeries, cancer therapies, or long-term medication can put a significant strain on one’s finances. Insurance helps mitigate these costs, allowing pet owners to focus more on the wellbeing of their dog rather than the financial implications of necessary care. Types of Coverage

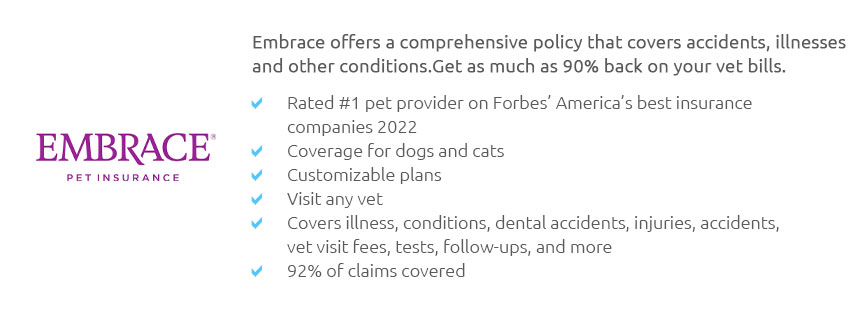

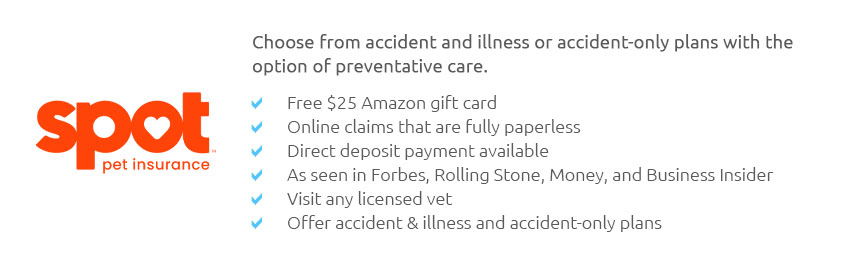

When evaluating policies, pet owners should consider factors such as the age and breed of their dog, which can affect premium costs. Some breeds are predisposed to certain health issues, making insurance a worthwhile consideration. Moreover, enrolling a pet at a younger age might result in lower premiums and broader coverage options, as insurers may exclude pre-existing conditions from coverage. It’s also vital to read the fine print. Policies vary in terms of deductibles, reimbursement levels, and coverage limits. A higher deductible typically means lower monthly premiums but requires more out-of-pocket spending before coverage kicks in. Reimbursement rates determine how much of the veterinary bill the insurer will cover, usually ranging from 70% to 90%. Choosing the Right Provider The pet insurance market is competitive, with numerous companies vying for your business. Companies such as Healthy Paws, Nationwide, and Trupanion are popular choices, each offering unique plans and benefits. When comparing providers, consider customer reviews, claim processes, and the overall reputation of the company. A smooth, hassle-free claims process is essential, as is responsive customer service. While some may view pet insurance as an unnecessary expense, many pet owners find value in the security it provides. Knowing that one can afford the best possible care for their dog, regardless of the situation, is a comforting thought. Ultimately, whether or not to invest in dog health insurance is a personal decision, but it’s one worth considering for the love and peace of mind it can bring. https://www.progressive.com/pet-insurance/

Pets Best offers an affordable, fixed-price pet insurance plan for broken bones, bite wounds, accidental swallowing of foreign objects, and other common ... https://www.allstate.com/pet-insurance

Pet health insurance helps cover certain medical expenses for your pet. It can provide peace of mind when your cat or dog has an ... https://www.insurance.ca.gov/01-consumers/105-type/8-pet/pet-qa.cfm

If your pet has a health issued identified as a congenital anomaly or disorder the insurer will not pay for treatment related to that disorder. Is there a ...

|